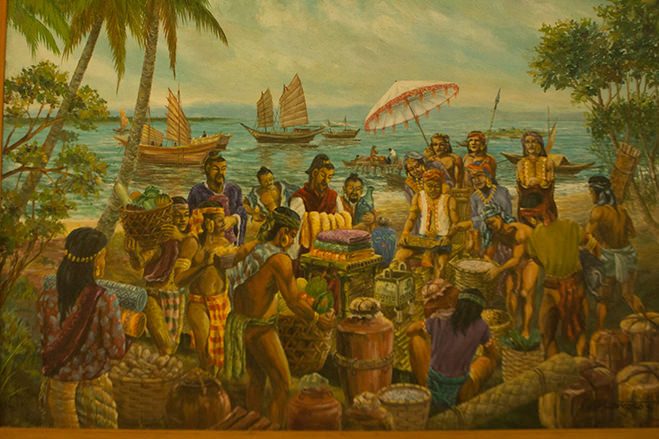

Pre colonial Era - Spanish Era - American Era

Pre colonial Era - Spanish Era - American Era

Taxation is a term for when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Paying taxes to governments or officials has been a mainstay of civilization since ancient times.

The term "taxation" applies to all types of involuntary levies, from income to capital gains to estate taxes. Though taxation can be a noun or verb, it is usually referred to as an act; the resulting revenue is usually called "taxes."